Restaurant for Sale: Buyer’s Guide and Featured Listings

Last Updated: January 6, 2026

Buying a restaurant for sale bypasses the riskiest startup phase, delivering a proven business foundation.

The reality of the U.S. restaurant industry is a challenging one, with an estimated 30% failure rate during the initial years. Starting a restaurant from scratch can therefore feel like a risky gamble.

But when you buy an already existing restaurant, you gain the advantages of an established customer base, a recognized brand, existing positive reviews, tools like a restaurant order management system, equipment, and immediate revenue from the moment you take the keys.

However, buying a restaurant is not without its pitfalls. This guide will walk you through the smart move of purchasing a restaurant.

How to evaluate a restaurant for sale

Before buying a restaurant, you need to scrutinize its financial performance, operational efficiency, and legal standing.

This in-depth examination of every piece of information is crucial for accurately determining the business's true value and potential.

1. Conduct a financial analysis

Of course, one of the most important steps in determining whether a restaurant is worth buying, aside from the restaurant cost is understanding the potential return on your investment.

Here are the essential financial details you should examine:

Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA)

Knowing how to calculate EBITDA is important because it shows how much the restaurant generates before any deductions. A high EBITDA means the restaurant is operating efficiently and generating strong profits from its core business activities.

To determine whether the restaurant and other businesses (for future reference) are performing well in terms of EBITDA margin, you can refer to this benchmark from research conducted by MetricHQ, an open community business metrics.

Profit and loss statements

A review of past and current income statements is the ultimate financial health check when learning how to buy a restaurant. It allows you to track the restaurant's growth trajectory by directly comparing key figures, such as revenue and gross profit, against the true cost of doing business — operating expenses.

This analysis doesn't just show you the restaurant profit margin but precisely how much it costs to operate, revealing the real net income and the effectiveness of management over time.

Debts and liabilities

While a good income statement shows the restaurant is profitable on paper, the actual financial picture isn't complete without checking the balance sheet.

Why does debt matter more than just income?

A high-income number can be misleading if the restaurant is incurring substantial debt (liabilities). It's the difference between looking successful today and being financially stable long-term.

Common debts and liabilities to watch for include:

- Money borrowed to finance renovations, equipment, and operations

- Rent or long-term lease commitments

- Vendor and supplier balances

- lawsuits or settlements that could impact finances

- Taxes

You have to look at the balance sheet along with the income statement. A restaurant with high income but massive debt is much riskier and less valuable than a restaurant with moderate income and zero debt. Debt is a mortgage on future earnings.

2. Check the location

There is often a tendency to buy the cheapest in an effort to save money, without knowing the danger of cheap restaurants. Keep in mind that ‘cheap’ is usually cheap for a reason.

That's why you should learn how to choose a restaurant location carefully.

For example, restaurants in remote locations or areas with low foot traffic are often priced lower because they are not prime destinations.

Customers typically visit these places only if they happen to be nearby, are passing through, or are on vacation, rather than as a regular choice.

3. Inspect the physical assets

When you buy a restaurant, you're not just buying a location and a customer list; you're buying a collection of physical assets that are constantly depreciating (losing value).

When inspecting assets, you are trying to calculate the difference between the equipment's book value (what the seller claims it's worth) and its real-world replacement cost.

That gap is a potential hidden cost you need to factor into the negotiation. If everything is old, your future capital expenditure (CapEx) budget will be much higher.

4. Secure licenses and titles

These aren't just bureaucratic hurdles; they are proof that the business operates safely and legally. Permits and licenses include:

- Health and safety permit

- Alcoholic beverages license

- Business license and permit

When purchasing an existing restaurant, you need to verify not only that the current owner has restaurant insurance but also the process and cost for transferring them (or reapplying for them) in your name.

Moreover, ensure that you secure a clean property title first. This helps avoid potential disputes, including family arguments, over ownership in the future.

5. Study the market and competition

Conduct a thorough investigation of nearby competitors. If the nearest competitor is struggling, determine the reasons; this may reveal an opportunity or point to a market problem, such as inadequate parking or poor access, that will also affect your business.

This means understanding the existing customer base, the established price point, and the general public perception of the location. Are you buying the “local favorite,” or the place everyone avoids? That position is your starting line.

List of restaurant businesses for sale in the U.S.

The following list is sourced from Biz Buy Sell, a reliable online marketplace for buying and selling businesses.

You’ll find a range of options here, from casual diners to fine dining spots, each offering different price points and profit potential.

If you’re ready to buy a restaurant or open the cheapest franchises in the US, this is one of the most reliable marketplaces to consider.

Disclaimer: All financial details, valuations, and descriptions are based on information provided by the sellers or brokers and have not been independently verified. Interested buyers should conduct their own due diligence, seek professional legal and financial advice, and confirm all details before making any investment decisions.

1. Sports bar and restaurant

Location: Michigan

Source: BizBuySell

This established venue, open daily and spanning more than 4,000 square feet with seating for over 100 guests, features 20 TVs, Keno, Pull Tabs, a complete outdoor patio, and a large paved parking lot, and it also includes a full Class C liquor license, a dance floor, and a Sunday morning sales license. Boasting a strong reputation and a prime location, the business is highly successful and presents an excellent investment opportunity.

Detailed information

- Asking price: $1,300,000

- Gross revenue: $1,700,000

- EBITDA: $197,000

- Cash flow (SDE): $525,000

- Inventory: $25,000 (Not included in asking price)

- Real estate: Owned (Included in asking price)

- Furniture, fixtures, and equipment (FF&E): $20,000 (Included in asking price)

- Facilities: Full Kitchen, Office, Bar, and dining area. New roof. The building is in excellent shape.

- Growth and expansion: Various growth opportunities. No outside advertising has been done. Growth has been through word of mouth.

2. Fine dining restaurant

Location: Georgia

Source: BizBuySell

This remarkable fine dining restaurant offers a rare opportunity to acquire an award-winning establishment with more than eleven years of proven success in the thriving and revitalized Northeast Georgia area. Since its founding in 2014, this turnkey operation has built a loyal following and an outstanding reputation, allowing it to stand out in the competitive fine dining scene.

Detailed information

- Asking price: $2,695,000

- Gross revenue:$1,420,275

- EBITDA: $415,000

- Cash flow (SDE): $435,949

- Real estate: Owned

- Building SF: 2,500

- Employees: 11 (3 Full-time, 8 Part-time)

- Property and assets: Complete turnkey package includes real estate, furniture, fixtures, equipment, and proprietary recipes

- Support and training: Owner/Chef is willing to stay on board to help with transition and training.

3. Italian Restaurant

Location: Phoenix, AZ, Maricopa County

Source: BizBuySell

This iconic Italian restaurant, operating successfully since 1985, is highly profitable and efficiently managed, and it enjoys a massive and loyal following along with near-perfect reviews.

Generating $170,000 in owner earnings while being open only 20 hours per week, the business also allows the owners to take six weeks off every summer, making it a truly exceptional opportunity.

Detailed information

- Asking price: $510,000

- Gross revenue: $1,057,784

- Cash flow (SDE): $170,040

- Real estate: Rent ($3,804 per Month)

- Building SF: 1,800

- Competition: There are no other restaurants in the center, and there is excellent visibility from the very busy street.

- Support and training: Two weeks of training

4. Contemporary restaurant and bar

Location: Chicago, IL

Source: BizBuySell

This is a beautifully designed American restaurant with a unique, stylish look. It’s popular for dinner, lunch, and weekend brunch, with a lively lounge and bar scene, especially for sports fans. The sale includes all furniture, equipment, and licenses, making it an easy transition.

Detailed information

- Asking price: $695,000

- Gross revenue: $4,000,000

- Cash flow (SDE): $400,000

- Real estate: Rent ($3,804 per Month)

- Inventory: $50,000 (Included in asking price)

- FF&E: $500,000 (Included in asking price)

- Financing: $350K down payment

- Support and training: 30 + days of direct contact with owners

5. Bar and restaurant

Location: Michigan

Source: BizBuySell

This family-owned restaurant caters to both travelers and the local community, serving a diverse menu of American favorites and hand-tossed pizzas in a welcoming atmosphere.

Priced for a quick sale, the owner is ready to transfer ownership once a conditional liquor license is approved, allowing immediate profits and cash flow. Experienced FOH and BOH management are in place, and the building and kitchen equipment are in good condition.

Detailed information

- Asking price: $749,000

- Gross revenue: $1,200,000

- Cash flow (SDE): $180,000

- Inventory: $25,000 (Not included in asking price)

- Real estate: Owned (Included in asking price)

- FF&E: $100,000 (Included in asking price)

- Employees: 30

- Financing: cash, conventional, SBA

- Support and training: 40 hours of transitional training and support are included in the sale. Any other training and/or support can be negotiated

6. Quick-service Greek restaurant

Location: Galveston County, TX

Source: BizBuySell

This is an excellent opportunity to own a profitable restaurant franchise for sale in the Houston area. Located in the popular Baybrook Mall’s restaurant row, the business benefits from heavy foot traffic, a steady mix of customers, and a prime spot in one of the busiest shopping destinations in the region.

The business is fully set up and ready for you to take over right away.

Detailed information

- Asking price: $385,000

- Gross revenue: $1,483,031

- EBITDA: $144,379

- Cash flow (SDE): $259,640

- Inventory: $9,800 (Included in asking price)

- Real estate: leased

- FF&E: $140,054 (Included in asking price)

- Employees: 16

- Financing: Franchisor will provide financing options

- Franchise: This business is an established franchise

- Support and Training: The comprehensive support package includes a complete 4-week training program from the franchisor, well-trained and experienced staff in place, and a current owner available for transition support

7. Bakery and coffee shop

Location: Los Angeles County, CA

Source: BizBuySell

This is an established and profitable bakery with a loyal customer base, offering a turnkey opportunity complete with equipment, inventory, and established branding.

The business is well-known for its fresh bread, gourmet pastries, wedding cakes, cupcakes, and cookies. It also features a growing catering arm with minimal local competition, offering significant potential for expansion. Owner financing is available, and the price is negotiable for the right buyer.

Detailed information

- Asking price: $350,000

- Gross revenue: $640,000

- EBITDA: $150,000

- Inventory: $18,000 (Included in asking price)

- Real estate: leased

- Building SF: 2,700

- Lease expiration: 11/26/2027

- Employees: 9

- Facilities: included all FF&E

- Financing: $150,000 in a finance loan, plus a negotiable price and owner financing

- Support and training: training up to 4 weeks

8. Quick-Service Franchise

Location: Los Angeles County, CA

Source: BizBuySell

Here’s a rare chance to own a profitable, established quick-service franchise in a prime downtown East Bay location. The business has been under the same owner since 2019 and brought in over seven figures in revenue last year.

This store ranks among the top performers in the franchise system nationwide, and with SBA pre-qualification already in place, it’s a strong opportunity for qualified buyers looking for a proven business.

Detailed information

- Asking price: $1,252,292

- Gross revenue:$1,862,000

- EBITDA: $333,036

- Cash flow (SDE): $333,036

- Inventory: $10,000 (Not included in asking price)

- Real estate: leased

- Building SF: 1,500

- Lease Expiration: 2/16/2035

- FF&E: $25,000 (Included in asking price)

- Employees: 20

- Financing: SBA pre-Qualified, open to limited seller financing for qualified buyers

9. Mexican restaurant and bar

Location: Los Angeles County, CA

Source: BizBuySell

This is a great opportunity to acquire a high-grossing, high-net Mexican restaurant with a full bar that is fully staffed and employee-run.

The business is located on a busy street surrounded by numerous businesses and residential communities, ensuring a steady flow of both vehicle and foot traffic.

Currently, the owners maintain a complete team of staff, and the operation is entirely management and employee-run, which results in higher payroll-related expenses but allows for hands-off ownership.

Detailed information

- Asking price: $900,000

- Gross revenue: $1,181,601

- Cash flow (SDE): $360,823

- Inventory: $18,000 (Not included in asking price)

- Real estate: leased

- Current rent: $8,300 Per Month

- License: ABC Type – 47(Full Liquor)

- Building SF: 3,500

- Lease Expiration: January 2030

Note: All potential buyers must execute an NDA, complete a buyer profile, and provide proof of funds, and they must also agree to refrain from any direct communication with the facility or its administrative staff as part of the pre-due diligence phase of the sale.

10. Sandwich shop and catering business

Location: San Diego County

Source: BizBuySell

An award-winning deli, established in 2008 in the center of a thriving biotech corridor, now offers buyers the chance to acquire a proven and profitable business, and it draws both a loyal customer base and steady traffic from nearby corporate campuses.

North County Magazine recently honored the business as a Gold Winner for Best Deli, and with the owners preparing to retire, this presents an excellent opportunity for an entrepreneur or investor to step into a well-established operation with room to grow.

Detailed information

- Asking price: $139,000

- Gross revenue: $255,402

- Cash flow (SDE): $79,066

- Building SF: 1,149

- FF&E: $139,000 (included in asking price)

- Employees: 2

- Real estate: leased

- Lease Expiration: 12/31/2031

- Support and training: 30 Hours in One Week

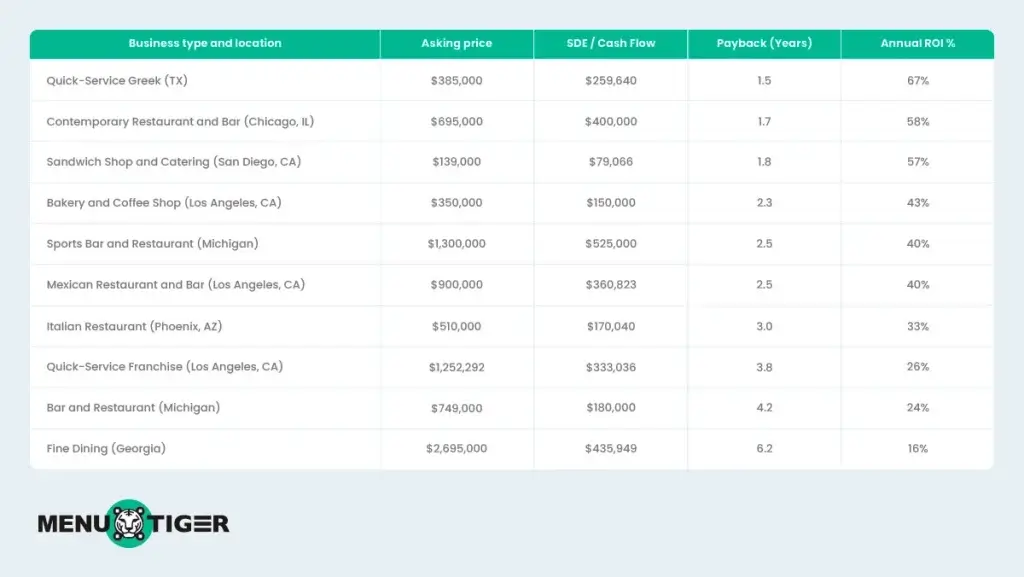

Return on investment and payback period analysis

These businesses are “profitable” because they’re generating positive cash flow relative to their sales and asking price. The real question for a buyer is ROI (return on investment), how quickly you can earn back your purchase price.

Formula:

According to Investopedia, a leading finance education platform, the payback period can be calculated using the formula:

- Payback period = asking price (Investment) ÷ SDE (cash flow)

Morgan and Westfield, a business brokerage and valuation firm, explains that ROI for a small business can be calculated as:

- ROI (%) = (SDE ÷ asking price) × 100

Note: ROI can be calculated in different ways depending on the context. Review return on investment formulas carefully.

5 essential tips to avoid costly mistakes when buying a restaurant

Buying a restaurant is an exciting opportunity, but the process is full of financial and legal landmines. To ensure your dream doesn't turn into a financial nightmare, here are five essential tips to avoid costly mistakes when purchasing a restaurant.

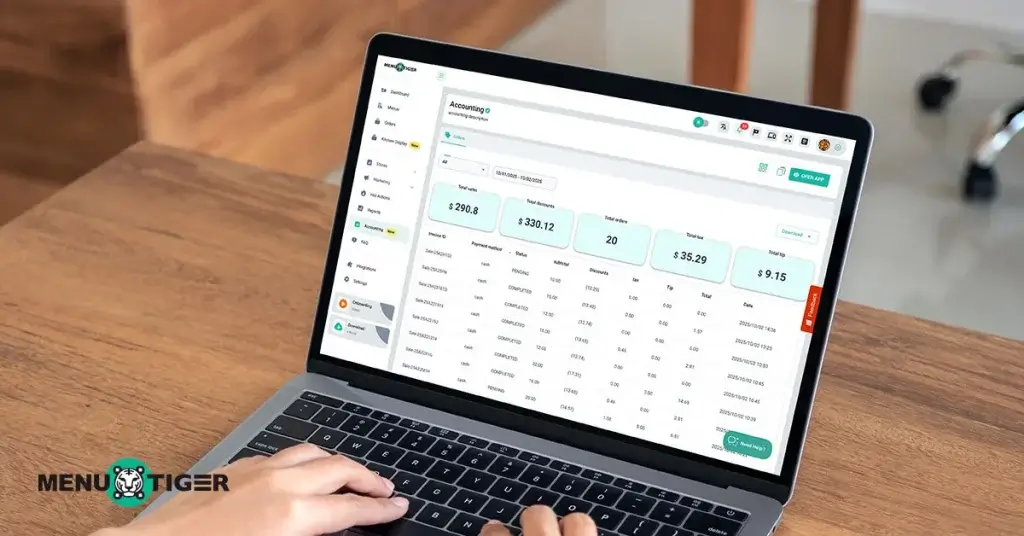

1. Ask for the restaurant’s order management sales report

The tip is to demand to see the restaurant order management accounting information to better understand the business.

In the restaurant industry, sellers may present an inflated Profit and Loss (P&L) statement to justify a higher asking price. They do this by claiming non-existent expenses to show lower profit (and lower taxes), which they promise to “add back” to your income.

If the sales are not accurately recorded, you will overpay for the business based on fake income.

2. Don't inherit the seller's debt or legal issues

One mistake to avoid is failing to check for past-due taxes, unpaid vendor bills, or potential lawsuits because you can unknowingly buy a profitable business only to find a looming financial or legal disaster.

Have professionals run a check of court records for any pending litigation (for example, labor disputes, discrimination claims, or vendor lawsuits).

3. Don't ignore the physical state of the equipment

Before closing the deal, hire a certified inspector or an experienced restaurant contractor. to evaluate the condition and estimated lifespan of major equipment.

If major equipment needs replacement (for example, within 1-2 years), use the estimated cost to negotiate a reduction in the asking price.

4. Get a non-compete agreement and secure key staff

Don't let the seller walk away and immediately open the “same concept” restaurant a mile down the road, taking the best recipes, customers, and employees with them. The sale of the “goodwill” of the business must be protected.

You can have a legal agreement or contract in which the seller signs a robust non-compete clause, preventing them from opening a similar business within a defined geographical area for a reasonable period (for example, 3–5 years).

5. Always consult with professionals when you buy a business

Now, ask yourself: Are you willing to risk overpaying for a business whose biggest problems are still hidden in its paperwork?

Never rely solely on the seller's representations or your own assumptions. Surround yourself with a team of professionals, including a restaurant broker, attorney, accountant, and inspector.

Analyze the restaurant analytics with them; their expertise acts as your safeguard, ensuring the deal is sound and protecting you from costly mistakes.

Own Smarter: Turn a restaurant for sale into a profitable venture

The path to success with a restaurant for sale hinges on due diligence that looks beyond the surface. While the immediate foundations of customers and cash flow are major wins, you must meticulously analyze and critically assess everything.

A crucial operational step is understanding the existing core systems, demanding access to the Point of Sale (POS) data and menu management platform.

Don't rely solely on the seller's word; rely on smart strategy and professional guidance to secure a deal that guarantees both stability and growth.

FAQS

Eulla

Eulla joined MENU TIGER’s Content Team with a foundation in English teaching. She combines language expertise and creativity to produce engaging content that educates audiences and drives meaningful results.